All Categories

Featured

Table of Contents

If you're someone with a reduced tolerance for market fluctuations, this understanding can be important - Indexed Universal Life calculator. Among the crucial aspects of any insurance plan is its expense. IUL plans frequently come with different charges and fees that can influence their total value. A financial consultant can break down these prices and assist you consider them versus various other low-priced investment options.

Don't simply think about the costs. Pay particular interest to the plan's features which will certainly be essential relying on how you wish to utilize the plan. Speak with an independent life insurance policy agent that can assist you select the most effective indexed global life plan for your requirements. Total the life insurance policy application in complete.

Review the policy very carefully. Now that we have actually covered the advantages of IUL, it's important to understand how it compares to other life insurance plans offered in the market.

By recognizing the resemblances and distinctions in between these plans, you can make a more informed decision concerning which kind of life insurance policy is finest suited for your demands and economic goals. We'll start by comparing index global life with term life insurance, which is typically considered one of the most straightforward and affordable type of life insurance policy.

How can Flexible Premium Indexed Universal Life protect my family?

While IUL might supply greater potential returns as a result of its indexed cash money worth development device, it likewise features higher premiums compared to label life insurance coverage. Both IUL and whole life insurance policy are kinds of irreversible life insurance plans that supply death advantage security and cash value development chances (IUL for wealth building). There are some vital differences between these two kinds of plans that are vital to consider when determining which one is best for you.

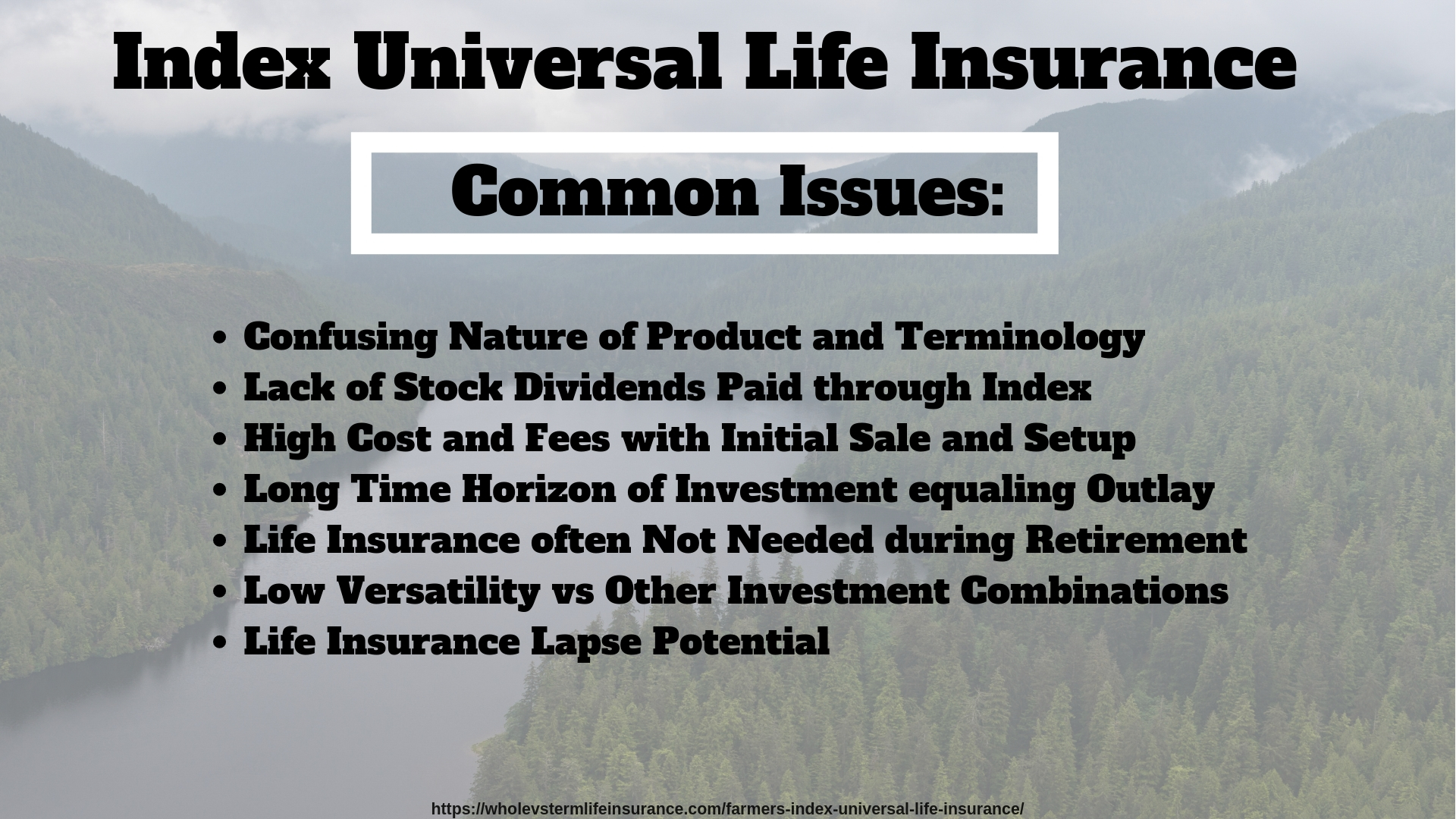

When thinking about IUL vs. all various other sorts of life insurance policy, it's important to consider the pros and cons of each policy kind and seek advice from an experienced life insurance representative or monetary advisor to identify the very best alternative for your special needs and economic goals. While IUL supplies several benefits, it's also crucial to be familiar with the dangers and factors to consider connected with this type of life insurance policy plan.

Let's delve deeper right into each of these threats. One of the primary worries when taking into consideration an IUL policy is the different expenses and costs connected with the plan. These can include the price of insurance coverage, plan charges, abandonment costs and any type of extra motorcyclist prices sustained if you add fringe benefits to the plan.

Some may offer much more affordable prices on coverage. Inspect the investment options offered. You want an IUL plan with a series of index fund options to meet your needs. Ensure the life insurance company aligns with your individual monetary objectives, demands, and risk tolerance. An IUL policy need to fit your details circumstance.

What does a basic Indexed Universal Life Death Benefit plan include?

Indexed universal life insurance coverage can give a number of benefits for insurance policy holders, including versatile costs settlements and the possible to earn greater returns. However, the returns are restricted by caps on gains, and there are no warranties on the market performance. All in all, IUL policies offer numerous prospective benefits, yet it is essential to understand their threats.

Life is not worth it for many people. For those looking for predictable long-term cost savings and guaranteed fatality benefits, entire life might be the far better choice.

Can I get Iul Vs Term Life online?

The benefits of an Indexed Universal Life (IUL) plan include possible higher returns, no downside risk from market motions, security, versatile settlements, no age requirement, tax-free survivor benefit, and financing schedule. An IUL policy is permanent and gives cash worth growth through an equity index account. Universal life insurance policy began in 1979 in the United States of America.

By the end of 1983, all major American life insurance companies offered global life insurance. In 1997, the life insurance company, Transamerica, presented indexed universal life insurance policy which provided insurance holders the capacity to link policy development with global securities market returns. Today, universal life, or UL as it is additionally understood can be found in a variety of various kinds and is a huge part of the life insurance policy market.

The details given in this short article is for academic and educational objectives only and need to not be understood as monetary or investment guidance. While the writer possesses knowledge in the subject issue, readers are encouraged to seek advice from with a certified financial expert prior to making any type of investment decisions or purchasing any life insurance coverage products.

What is the best Iul Interest Crediting option?

You might not have actually thought a lot concerning how you want to spend your retirement years, though you possibly understand that you don't desire to run out of money and you would certainly like to keep your current way of living. [video: Text appears next to the business man speaking to the camera that reads "company pension", "social security" and "savings". High cash value IUL.] < map wp-tag-video: Text appears alongside the business male talking to the electronic camera that reads "company pension plan", "social safety" and "cost savings"./ wp-end-tag > In the past, people depended on 3 main resources of revenue in their retirement: a company pension, Social Safety and whatever they 'd managed to save

Less employers are offering conventional pension. And several companies have minimized or discontinued their retirement. And your capability to rely entirely on Social Protection is in inquiry. Even if benefits have not been minimized by the time you retire, Social Safety alone was never ever planned to be sufficient to pay for the way of living you desire and deserve.

Prior to devoting to indexed global life insurance policy, right here are some advantages and disadvantages to consider. If you pick an excellent indexed global life insurance coverage plan, you might see your money value expand in value. This is practical due to the fact that you may be able to gain access to this cash before the strategy expires.

What is the difference between Indexed Universal Life Investment and other options?

If you can access it beforehand, it may be advantageous to factor it right into your. Since indexed global life insurance policy needs a specific level of danger, insurance provider tend to maintain 6. This sort of strategy likewise supplies. It is still guaranteed, and you can adjust the face quantity and cyclists over time7.

Generally, the insurance business has a vested rate of interest in doing much better than the index11. These are all variables to be thought about when choosing the ideal type of life insurance for you.

Nevertheless, since this kind of policy is much more complicated and has a financial investment part, it can frequently come with greater costs than various other policies like entire life or term life insurance policy - Indexed Universal Life insurance. If you don't assume indexed global life insurance policy is right for you, right here are some options to take into consideration: Term life insurance policy is a short-term plan that generally offers protection for 10 to 30 years

Latest Posts

Problems With Indexed Universal Life Insurance

Irl Insurance

Whole Life Vs Indexed Universal Life